XM Account

Whether you're a beginner or an experienced trader, knowing how to open an account and withdraw money from XM ensures that you can seamlessly manage your funds and enjoy the benefits of your trading success. This guide will walk you through the process of opening an XM account and how to easily withdraw your profits.

How to Open an Account on XM

How to Open an Account

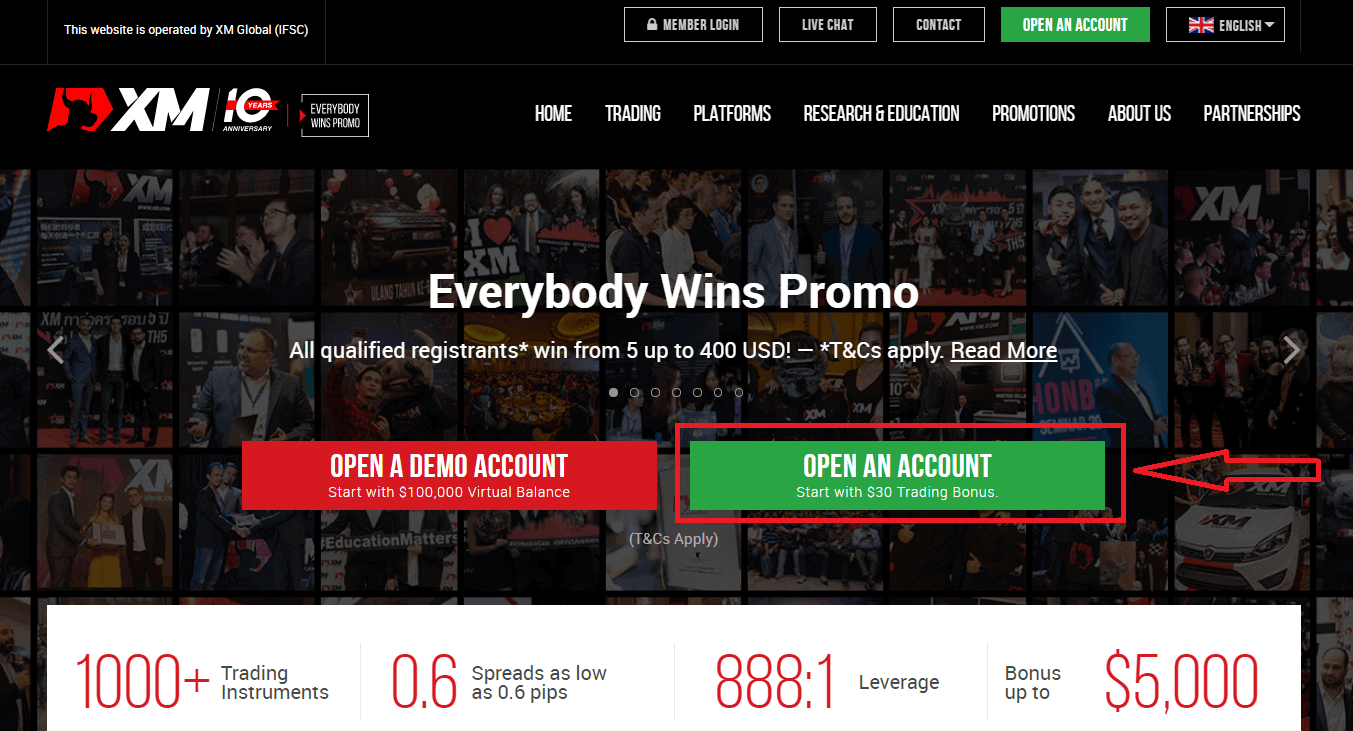

1. Go to the registration pageYou must first access the XM broker portal, where you can find the button to create an account.

As you can see in the central part of the page there is a green button to create an account.

The account opening is totally free.

It may take only 2 minutes to complete the online registration with XM.

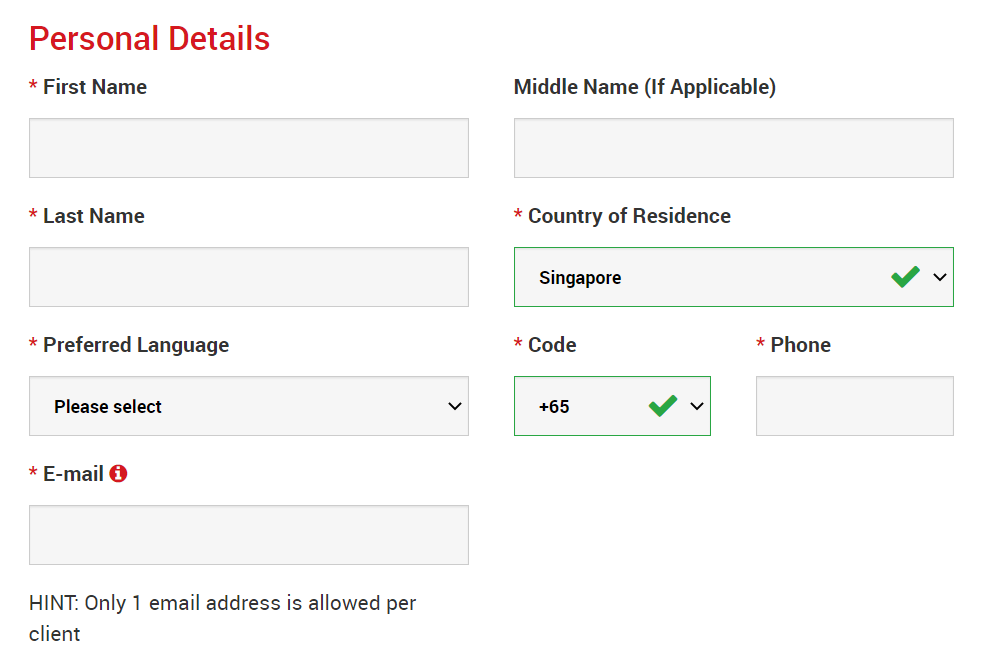

2. Fill in the required fields

There you will have to complete the form with the required information below.

- First Name and Last Name

- They are displayed in your identity document.

- Country of Residence

- The country you reside in may affect the account types, promotions and other service details available for you. In here, you may select the country you currently reside in.

- Preferred Language

- The language preference can be changed later too. By selecting your native language, you will be contact by support staffs who speak your language.

- Phone Number

- You may not need to make a phone call to XM, but they may call in some cases.

- Email Address

- Make sure you type in the correct email address. After the completion of the registration, all communications and logins will require your email address.

Please Note: Only one email address per client is allowed.

At XM you can open multiple accounts using the same email address. Multiple email addresses per client are not allowed.

If you are an existing XM Real account holder and you wish to open an additional account you must use the same email address already registered with your other XM Real Account(s).

If you are a new XM client please ensure that you register with one email address as we do not allow different email address for every account you open.

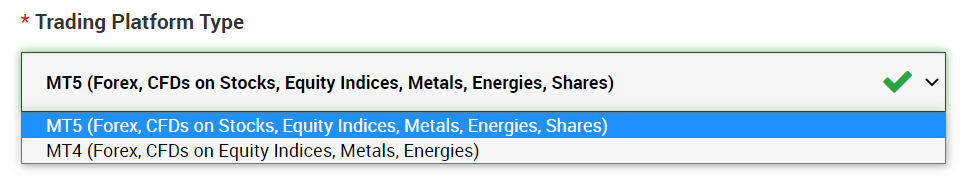

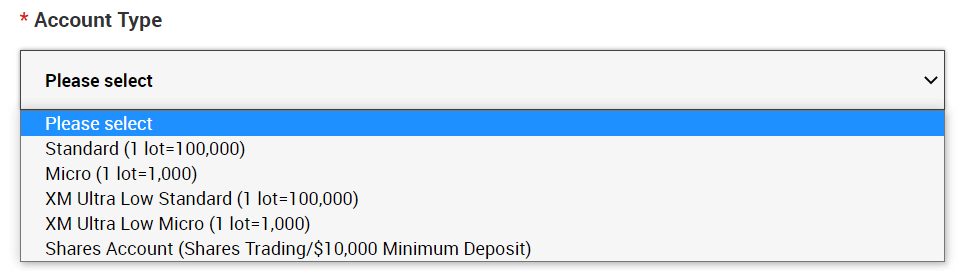

3. Choose your account type

Before proceeding to the next step, you must choose Trading Platform Type. You can also choose MT4 (MetaTrader4) or MT5 (MetaTrader5) platforms.

And the account type you like to use with XM. XM mainly offers Standard, Micro, XM Ultra Low Account and Shares Account.

After the registration, you can also open multiple trading accounts of different account types.

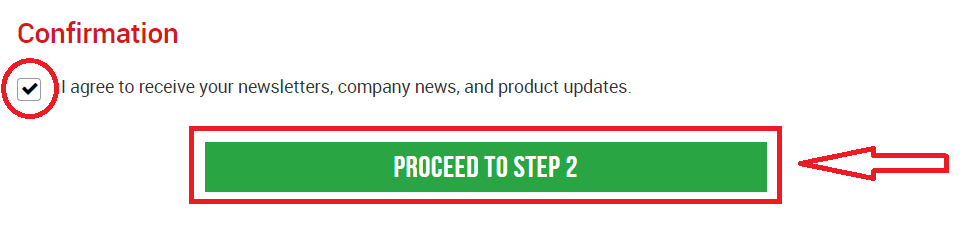

4. Agree to the Terms and Conditions

After filling in all the blanks, lastly, you need to click in the boxes and press "PROCEED TO STEP 2" as below

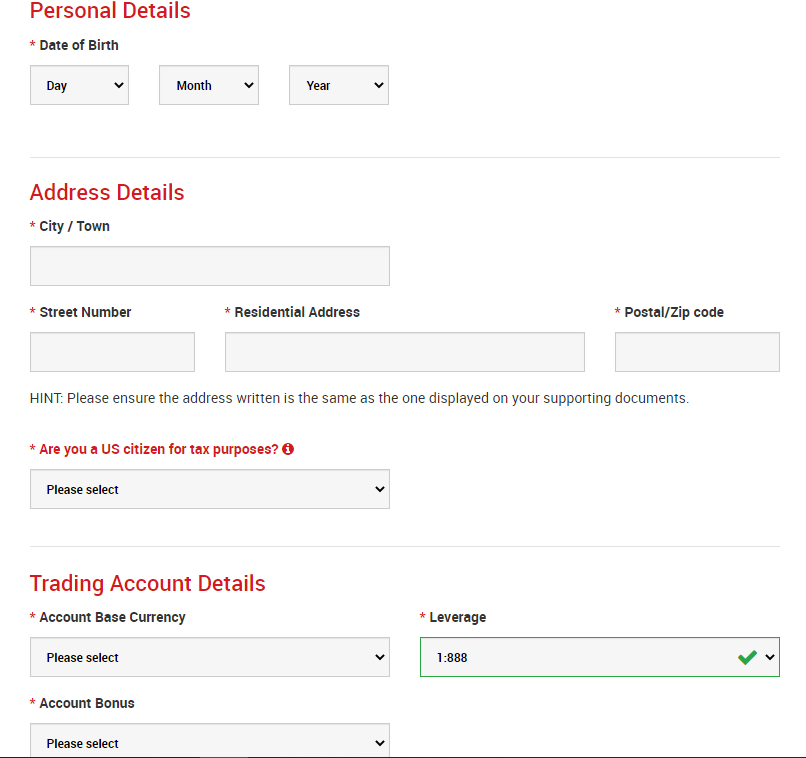

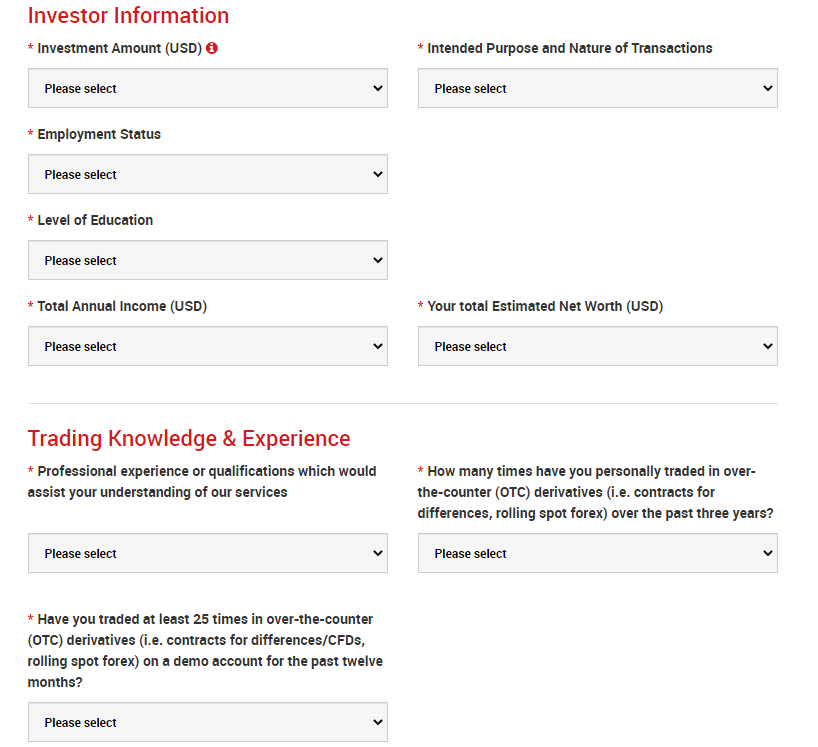

On the next page, you will need to fill in some more details about yourself and your investment knowledge.

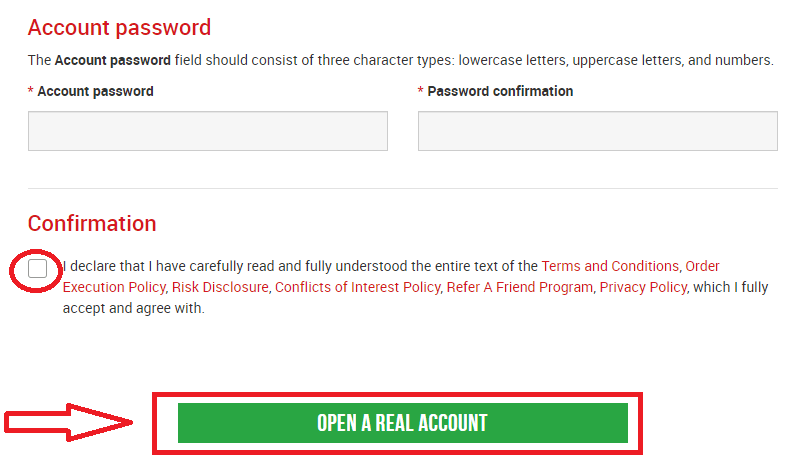

The Account password field should consist of three character types: lowercase letters, uppercase letters, and numbers.

After filling in all the blanks, lastly, you need to agree to the terms and conditions, click in the boxes, and press "OPEN A REAL ACCOUNT" as above

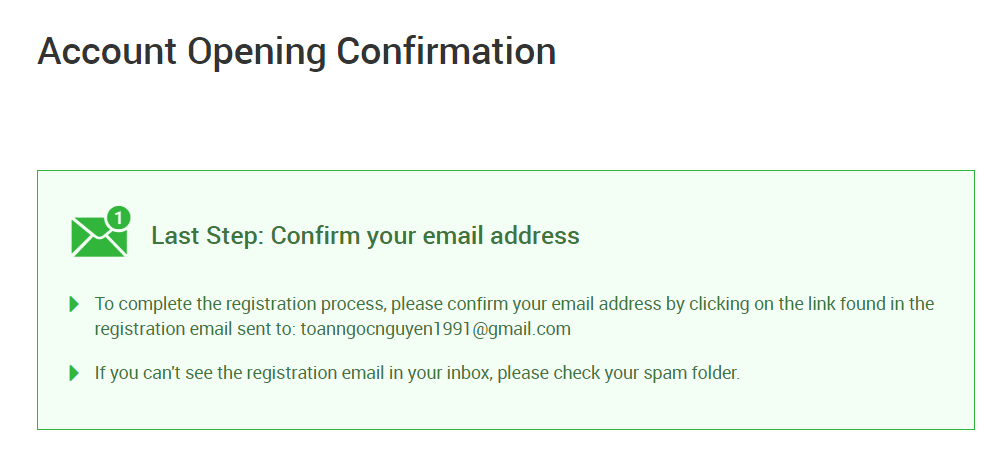

After this, you will receive an email from XM for email confirmation

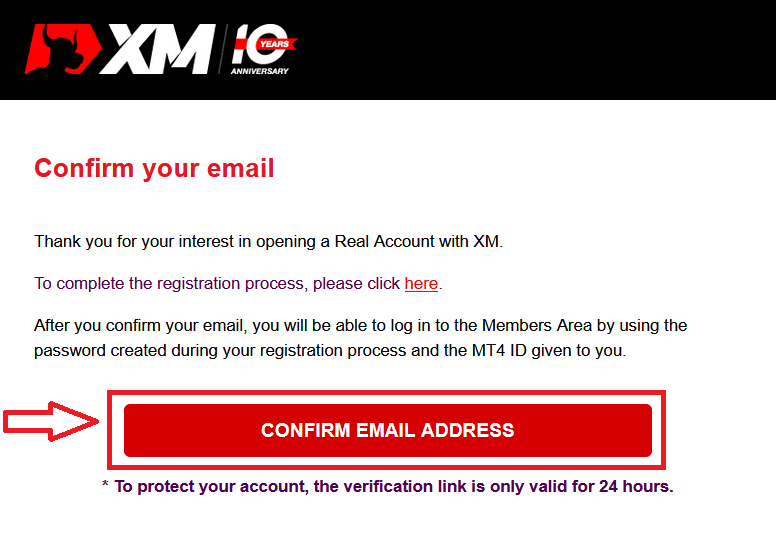

In your mailbox, you will receive an email like the one you can see in the following image. Here, you will have to activate the account by pressing where it says “Confirm email address“. With this, the demo account is finally activated.

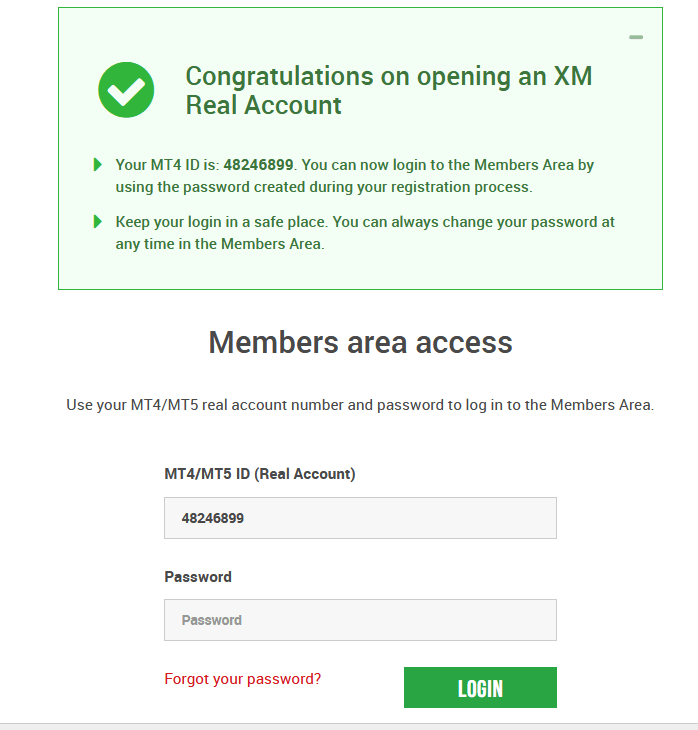

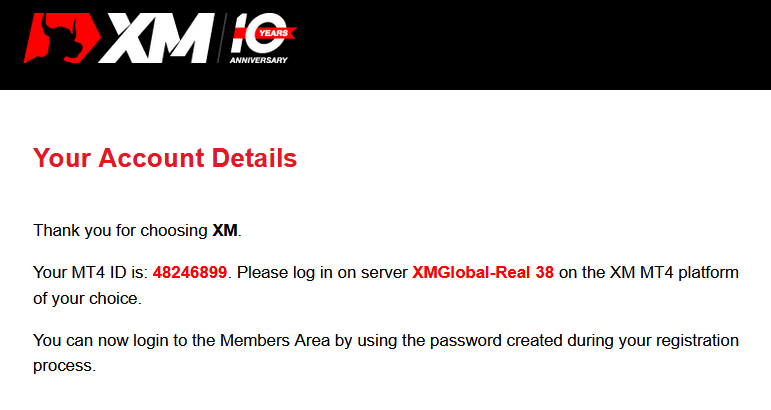

Upon confirmation of the email and account, a new browser tab will open with welcome information. The identification or user number that you can use on the MT4 or Webtrader platform is also provided.

Go back to your Mailbox, and you will receive login details for your account.

It should be remembered that for the version of Metatrader MT5 or Webtrader MT5, the account opening and verification process is exactly the same.

How to Deposit Money

What is a Multi-Asset Trading Account?

A multi-asset trading account at XM is an account that works similarly to your bank account, but with the difference that it is issued with the purpose of trading currencies, stock indices CFDs, stock CFDs, as well as CFDs on metals and energies.Multi-asset trading accounts at XM can be opened in Micro, Standard, or XM Ultra Low formats as you can view in the table above.

Please note that multi-asset trading is available only on MT5 accounts, which also allows you access to the XM WebTrader.

In summary, your multi-asset trading account includes

1. Access to the XM Members Area

2. Access to the corresponding platform(s)

3. Access to the XM WebTrader

Similarly to your bank, once you register a multi-asset trading account with XM for the first time, you will be requested to go through a straightforward KYC (Know your Customer) process, which will allow XM to make sure that the personal details you have submitted are correct and ensure the safety of your funds and your account details. Please note that if you already maintain a different XM Account, you will not have to go through the KYC validation process as our system will automatically identify your details.

By opening a trading account, you will be automatically emailed your login details which will give you access to the XM Members Area.

The XM Members area is where you will manage the functions of your account, including depositing or withdrawing funds, viewing and claiming unique promotions, checking your loyalty status, checking your open positions, changing the leverage, accessing support, and accessing the trading tools offered by XM.

Our offerings within the client’s Members Area are provided and constantly enriched with more and more functionalities, allowing our clients more and more flexibility to perform changes or additions to their accounts at any given time, without needing assistance from their personal account managers.

Your multi-asset trading account login details will correspond to a login on the trading platform that matches your type of account, and it is ultimately where you will be performing your trades. Any deposits and/or withdrawals or other setting changes you make from the XM Members Area will reflect on your corresponding trading platform.

Who Should Choose MT4?

MT4 is the predecessor of the MT5 trading platform. At XM, the MT4 platform enables trading on currencies, CFDs on stock indices, as well as CFDs on gold and oil, but it does not offer trading on stock CFDs. Our clients who do not wish to open an MT5 trading account can continue using their MT4 accounts and open an additional MT5 account at any time.Access to the MT4 platform is available for Micro, Standard, or XM Ultra Low as per the table above.

Who Should Choose MT5?

Clients who choose the MT5 platform have access to a wide range of instruments ranging from currencies, stock indices CFDs, gold and oil CFDs, as well as stock CFDs.Your login details to the MT5 will also give you access to the XM WebTrader in addition to the desktop (downloadable) MT5 and the accompanying apps.

Access to the MT5 platform is available for Micro, Standard, or XM Ultra Low as shown in the table above.

Frequently Asked Questions

What is the Main Difference Between MT4 Trading Accounts and MT5 Trading Accounts?

The main difference is that MT4 does not offer trading on stock CFDs.

Can I Hold Multiple Trading Accounts?

Yes, you can. Any XM client can hold up to 10 active trading accounts and 1 share account.

What trading account types do you offer?

- MICRO: 1 micro lot is 1,000 units of the base currency

- STANDARD: 1 standard lot is 100,000 units of the base currency

- Ultra Low Micro: 1 micro lot is 1,000 units of the base currency

- Ultra Low Standard: 1 standard lot is 100,000 units of the base currency

- Swap Free Micro: 1 micro lot is 1,000 units of the base currency

- Swap Free Standard: 1 standard lot is 100,000 units of the base currency

What are the XM Swap Free trading accounts?

With the XM Swap Free accounts clients can trade without swaps or rollover charges for holding positions open overnight. XM Swap Free Micro and XM Swap Free Standard accounts provide swap-free trading, with spreads as low as 1 pip, in forex, gold, and silver, as well as in future CFDs on commodities, precious metals, energies, and indices.

How long can I use a demo account?

At XM demo accounts do not have an expiry date, so you can use them as long as you want. Demo accounts that have been inactive for longer than 90 days from the last login will be closed. However, you can open a new demo account at any time. Please note that a maximum of 5 active demo accounts are allowed.

How can I find my server name on MT4 (PC/Mac)?

Click File - Click "Open an account" which opens a new window, "Trading servers" - scroll down and click the + sign at "Add new broker", then type XM and click "Scan".Once the scanning has been done, close this window by clicking "Cancel".

Following this, please try to log in again by clicking "File" - "Login to Trading Account" in order to see if your server name is there.

How to Withdraw Funds from XM

How to Withdraw

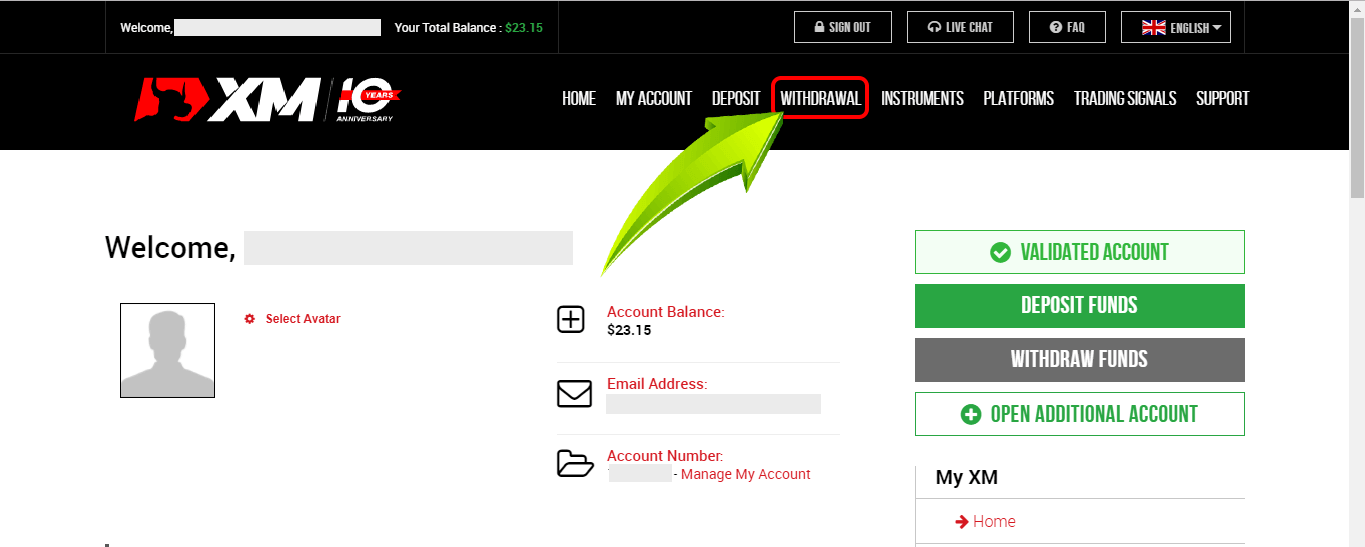

1/ Click the “Withdrawal” button on the My Account pageAfter logging in to My XM Group account, click “Withdrawal” on the menu.

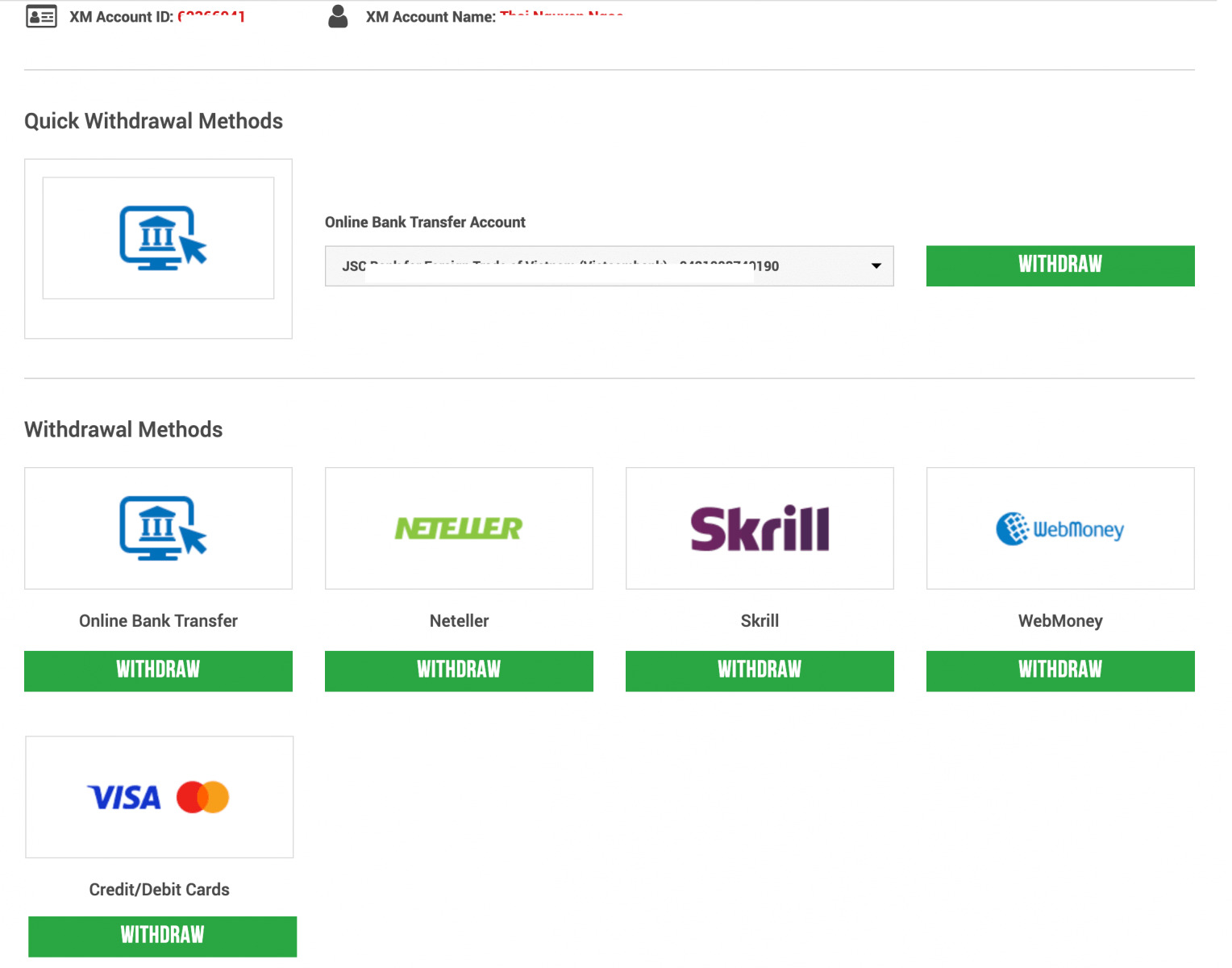

2/ Select Withdrawal options

Please note the following:

- We strongly suggest that you submit withdrawal requests after closing your positions.

- Please note that XM does accept withdrawal requests for trading accounts with open positions; however, to ensure the safety of our clients’ trades the following restrictions apply:

a) Requests which would cause the margin level to drop below 150% will not be accepted from Monday 01:00 to Friday 23:50 GMT+2 (DST applies).

b) Requests which could cause the margin level to drop below 400% will not be accepted during weekends, from Friday 23:50 to Monday 01:00 GMT+2 (DST applies).

- Please note that any withdrawal of funds from your trading account will result in the proportional removal of your trading bonus.

Credit/Debit cards can be withdrawn up to the deposit amount.

After withdrawing up to the amount deposited, you can choose to withdraw the remaining amount using whichever method you like.

For example: You deposit 1000 USD into your credit card, and you make a profit of 1000 USD after trading. If you want to withdraw money, you have to withdraw 1000 USD or the amount deposited using a credit card, the remaining 1000 USD you can withdraw by other methods.

| Deposit methods | Possible withdrawal methods |

|---|---|

| Credit/ Debit Card | Withdrawals will be processed up to the amount deposited by credit/ debit card. The remaining amount can be withdrawn via other methods |

| NETELLER/ Skrill/ WebMoney | Choose your withdrawal method other than credit or debit card. |

| Bank Transfer | Choose your withdrawal method other than credit or debit card. |

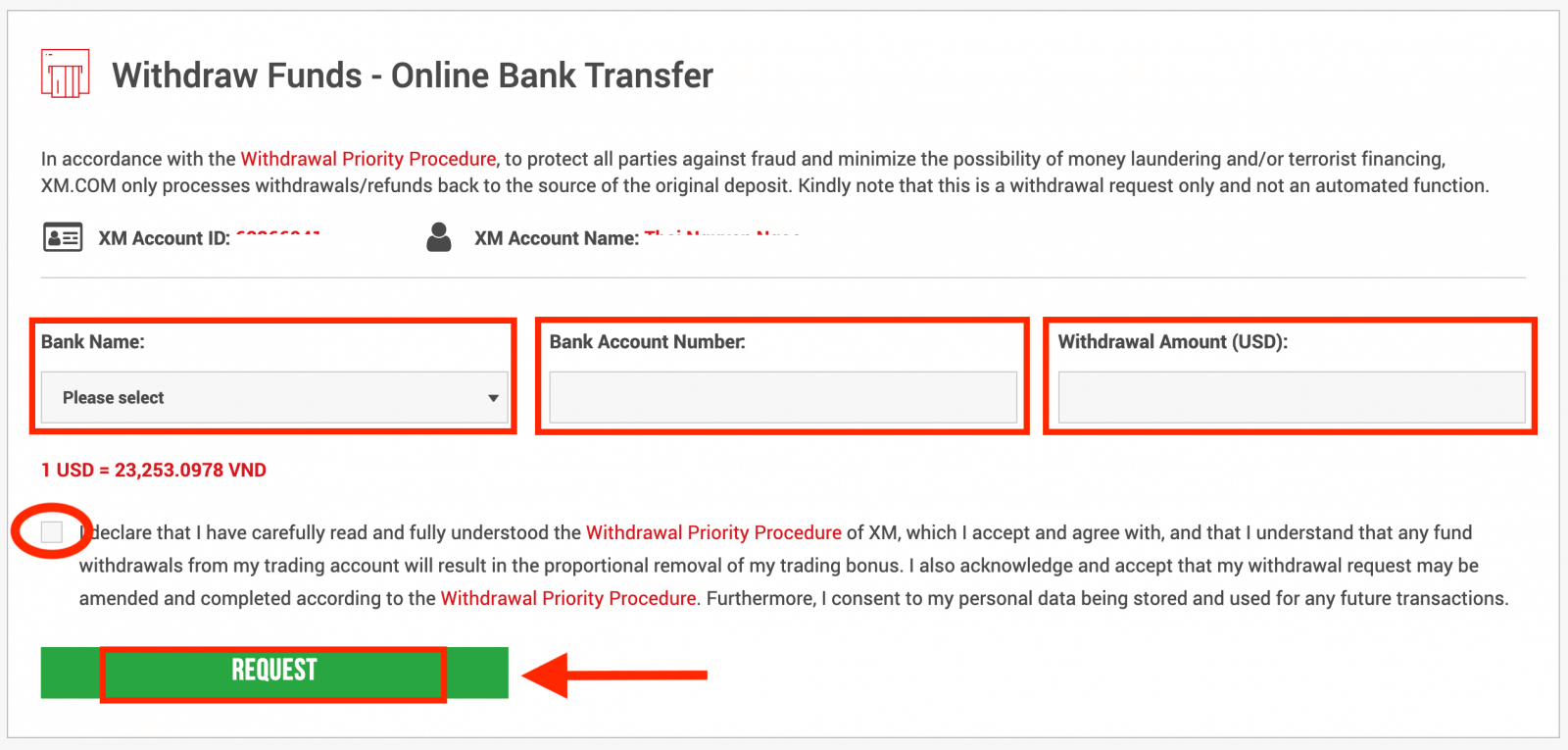

3/ Enter the amount you wish to withdraw and submit the request

For example: you choose "Bank Transfer", then select the Bank Name, enter Bank Account Number and the amount you wish to withdraw.

Click “Yes” to agree to the preferred withdrawal procedure, then click “Request”.

Thus, the withdrawal request has been submitted.

The withdrawal amount will be automatically deducted from your trading account. Withdrawal requests from XM Group will be processed within 24 hours (except Saturday, Sunday, and public holidays)

| Withdrawal methods | Withdrawal fees | Minimum withdrawal amount | Processing time |

|---|---|---|---|

| Credit/ Debit Card | Free | 5 USD ~ | 2-5 working days |

| NETELLER/ Skrill/ WebMoney | Free | 5 USD ~ | 24 working hours |

| Bank Transfer | XM covers all transfer fees | 200 USD ~ | 2-5 working days |

Disclaimers

XMP (bonus) that has been redeemed will be removed entirely even if you only withdraw 1 USD

At XM, a client can open up to 8 accounts.

Therefore, it is possible to prevent the removal of the entire XMP (bonus) by opening another account, transferring the investment amount to this account, and using it to withdraw money.

What payment options do I have to withdraw money?

We offer a wide range of payment options for deposits/withdrawals: by multiple credit cards, multiple electronic payment methods, bank wire transfer, local bank transfer, and other payment methods.As soon as you open a trading account, you can log in to our Members Area, select a payment method of your preference on the Deposits/Withdrawal pages, and follow the instructions given.

What is the minimum and maximum amount that I can withdraw?

The minimum withdrawal amount is 5 USD (or equivalent denomination) for multiple payment methods supported in all countries. However, the amount varies according to the payment method you choose and your trading account validation status. You can read more details about the deposit and withdrawal process in the Members Area.XM Withdrawal FAQ

What is the withdrawal priority procedure?

To protect all parties against fraud and minimize the possibility of money laundering and/or terrorist financing, XM will only process withdrawals/refunds back to the source of the original deposit according to the Withdrawal Priority Procedure below:- Credit/debit card withdrawals. Withdrawal requests submitted, regardless of the withdrawal method chosen, will be processed via this channel up to the total amount deposited by this method.

- E-wallet withdrawals. E-wallet refunds/withdrawals will be processed once all Credit/Debit card deposits have been completely refunded.

- Other Methods. All other methods such as bank wire withdrawals shall be used once deposits made with the above two methods have been completely exhausted.

All withdrawal requests will be completed within 24 working hours; however, all withdrawal requests submitted will be instantly reflected in the clients’s trading accounts as pending withdrawals. In case a client selects an incorrect withdrawal method, the client’s request will be processed according to the Withdrawal Priority Procedure described above.

All client withdrawal requests shall be processed in the currency in which the deposit was originally made. Should the deposit currency differ from the transfer currency, the transfer amount will be converted by XM into the transfer currency at the prevailing exchange rate.

How can I withdraw if my withdrawal amount exceeds the amount I deposited via credit/debit card?

Since we can only transfer the same amount back to your card as the amount you have deposited, profits can be transferred to your bank account via wire transfer. If you have also made deposits via E-wallet, you also have the option to withdraw profits to that same E-wallet.

How long does it take to receive my money after I make a withdrawal request?

Your withdrawal request is processed by our back office within 24 hours. You will receive your money on the same day for payments made via e-wallet, while for payments by bank wire or credit/debit card, it usually takes 2 - 5 business days.

Can I withdraw my money whenever I want?

To withdraw funds, your trading account must be validated. This means that first, you need to upload your documents in our Members Area: Proof of Identity (ID, passport, driving license) and Proof of Residency (utility bill, telephone/Internet/TV bill, or bank statement), which include your address and your name and can’t be older than 6 months.Once you receive confirmation from our Validation Department that your account has been validated, you can request the fund’s withdrawal by logging in to the Members Area, selecting the Withdrawal tab, and sending us a withdrawal request. It is only possible to send your withdrawal back to the original source of deposit. All withdrawals are processed by our Back Office within 24 hours on business days.

Are there any withdrawal fees?

We do not charge any fees for our deposit/withdrawal options. For instance, if you deposit USD 100 by Skrill and then withdraw USD 100, you will see the full amount of USD 100 in your Skrill account as we cover all transaction fees both ways for you.This also applies to all credit/debit card deposits. For deposits/withdrawals via international bank wire transfer, XM covers all transfer fees imposed by our banks, except for deposits amounting to less than 200 USD (or equivalent denomination).

If I deposit funds by e-wallet, can I withdraw money to my credit card?

To protect all parties against fraud and in compliance with the applicable laws and regulations for the prevention and suppression of money laundering, our company’s policy is to return clients’s funds to the origin of these funds, and as such the withdrawal will be returned to your e-wallet account. This applies to all withdrawal methods, and the withdrawal has to go back to the source of the funds deposit.

What is MyWallet?

It is a digital wallet, in other words, a central location where all the funds clients earn from various XM programs are stored.From MyWallet, you can manage and withdraw funds to the trading account of your choice and view your transaction history.

When transferring funds to an XM trading account, MyWallet is treated as any other payment method. You will still be eligible to receive deposit bonuses under the terms of the XM Bonus Program. For more information, click here.

Can I withdraw funds directly from MyWallet?

No. You must first send funds to one of your trading accounts before you can withdraw them.I am looking for a specific transaction in MyWallet, how can I find it?

You can filter your transaction history by ‘Transaction Type’, ‘Trading Account’, and ‘Affiliate ID’ using the dropdowns in your dashboard. You can also sort transactions by ‘Date’ or ‘Amount’, in ascending or descending order, by clicking on their respective column headers.

Can I deposit to/withdraw from my friend’s/relative’s account?

As we are a regulated company, we do not accept deposits/withdrawals made by third parties. Your deposit can only be made from your own account, and the withdrawal has to go back to the source where the deposit was made.

If I withdraw money from my account, can I also withdraw the profit made with the bonus? Can I withdraw the bonus at any stage?

The bonus is for trading purposes only, and cannot be withdrawn. We offer you the bonus amount to help you open larger positions and allow you to hold your positions open for a longer period. All profits made with the bonus can be withdrawn at any time.

Is it possible to transfer money from one trading account to another trading account?

Yes, this is possible. You can request an internal transfer between two trading accounts, but only if both accounts have been opened under your name and if both trading accounts have been validated. If the base currency is different, the amount will be converted. Internal transfer can be requested in the Members Area, and it is instantly processed.

What will happen to the bonus if I use internal transfer?

In this case, the bonus will be credited proportionally.

I used more than one deposit option, how can I withdraw now?

If one of your deposit methods has been a credit/debit card, you always need to request a withdrawal up to the deposit amount, as before any other withdrawal method. Only in case that amount deposited via credit/debit card is fully refunded back to the source, you may select another withdrawal method, according to your other deposits.

Are there any extra fees and commissions?

At XM we do not charge any fees or commissions. We cover all transaction fees (with bank wire transfers for amounts over 200 USD).

Conclusion: Simplify Your Trading Experience with XM

Opening an account and withdrawing funds with XM is a seamless process that caters to the needs of traders at all levels. By following this guide, you can set up your account quickly, start trading, and enjoy hassle-free withdrawals.

XM’s commitment to transparency, security, and efficiency ensures that your funds are always accessible when you need them. Start your trading journey today with XM and experience a broker that prioritizes your success at every step!